First some EDI basics.

In simple terms, EDI replaces manual business processes with automation.

Let’s begin with an example. In a typical (manual) buyer-supplier transaction, the buyer generates a purchase order and sends it to the supplier through paper, fax or other manual means.

The supplier then enters the purchase order into their system by hand, executes the purchase order, then creates and send the invoice to the buyer. Then the buyer enters the invoice into their computer system. Again, all these steps are manual processes.

Whether or not the documents travel by paper, fax, or other means, this process is time consuming, requires tedious manual data entry, is prone to error and delays, and increases the company’s costs. EDI automates manual processes to provide seamless electronic document exchange between partners. This computer to computer exchange of business information saves time and costs associated with paper processes.

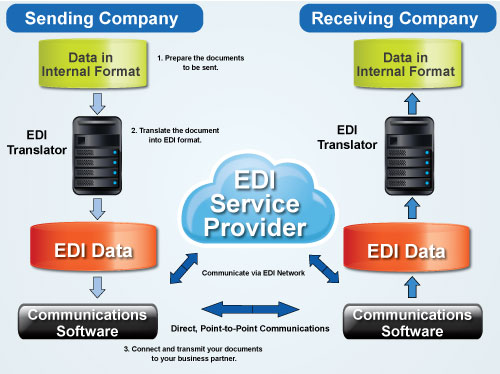

How Does EDI Work?

Now, let’s get technical. A company’s information is stored in an enterprise resource planning system, also known as an ERP. This information includes purchasing, inventory, billing and shipping details.

EDI software integrates with the ERP to use the stored information for EDI document transactions. Then the ERP system creates the POs and invoices. These documents are transferred to the EDI system through a file drop or web service call. Finally the system sends these documents between the company and its trading partners.

Each company in the supply chain has requirements for sending and receiving information. In addition, trading partners may use different information systems. All this variation means that there needs to be a system in place to “translate” the data into the required format for each company.

What Are EDI Standards?

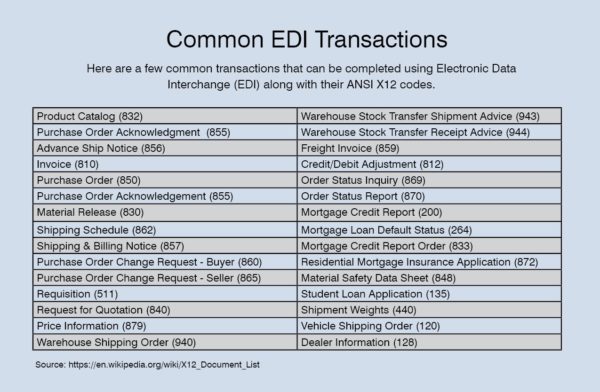

To ensure that the exchanged documents are compatible between the companies, an EDI format or standard is used. There are many EDI standards, as well as versions of each standard. Two of the most common EDI translation formats are ANSI X12 or EDIFACT.

Trading partners decide which standard to use during the implementation process. A trading partner typically uses a subset of the standard for each transaction they implement.

Also during EDI implementation, the EDI solution provider maps the data fields to comply with the standard and the trading partner requirements. This ensures that data is converted to the correct EDI format for the recipient’s system.

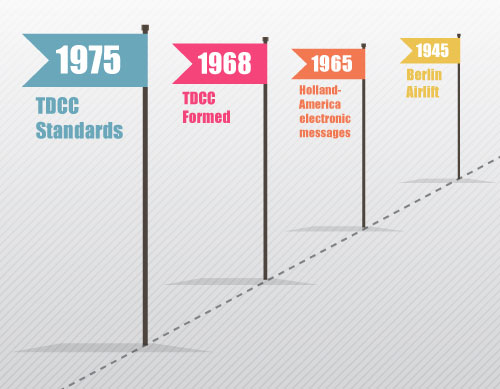

History of EDI

While EDI used for businesses dates back to the 1970’s, the premise dates back decades earlier to meet the needs of military logistics. To help facilitate the 1948 Berlin airlift, the U.S. military developed standardized shipping manifests to help organize the millions of tons of goods delivered into West Berlin.

In the 1960’s, the shipping industry was next to realize the potential of automated data interchange. The earlier standard documentation procedure was expanded upon with an electronic message format to send cargo information between steamships. In 1965, the Holland-America steamship line sent shipping manifests across the Atlantic using telex messages.

In 1968, a group of railroad companies formed the Transportation Data Coordinating Committee (TDCC). Its mission was to develop standard formats needed by oceanic shipping, railroads, airlines, and trucking companies which were exchanging electronic messages.1

The TDCC released the first EDI standards in 1975. Over the next few years, the TDCC eventually morphed into the current ANSI X12 committee (American National Standards Institute), responsible for the publication of EDI standards.2

By the 1980’s, widespread use included industries such as transportation, food, pharmaceuticals, warehouse, and banking. Also, industry leaders in automotive and retail began to mandate EDI for their suppliers. This included Ford, General Motors, Sears, and Kmart.1

Today, more than 100,000 companies in the U.S. alone use EDI to communicate with business partners. Over 90% of Fortune 500 companies are EDI capable, with increasing small business saturation.

What Is EDI Used For?

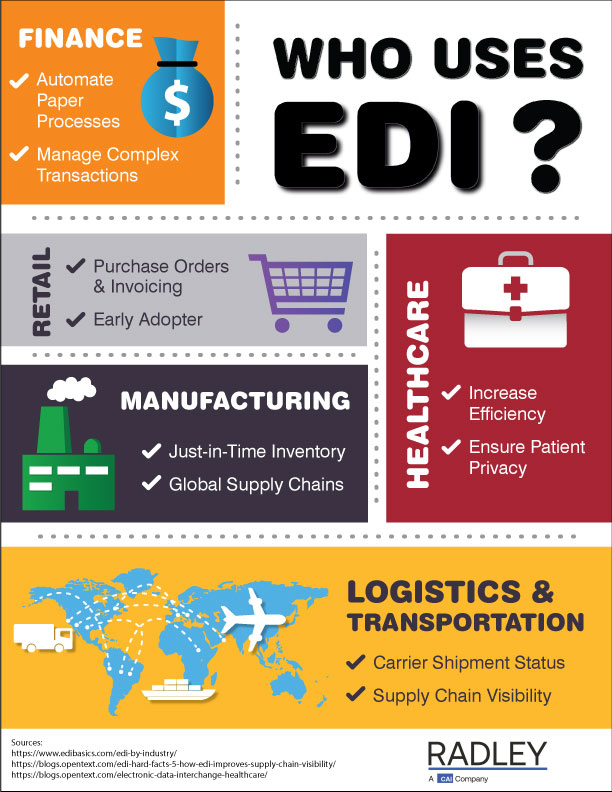

Which Industries Use EDI?

Given its long history, it’s no surprise that EDI has found its way into a wide range of industries. From transportation and logistics, to healthcare, financing and manufacturing, it’s proven its worth.

EDI for Automotive

EDI for Finance

EDI for Tech

EDI for Retail

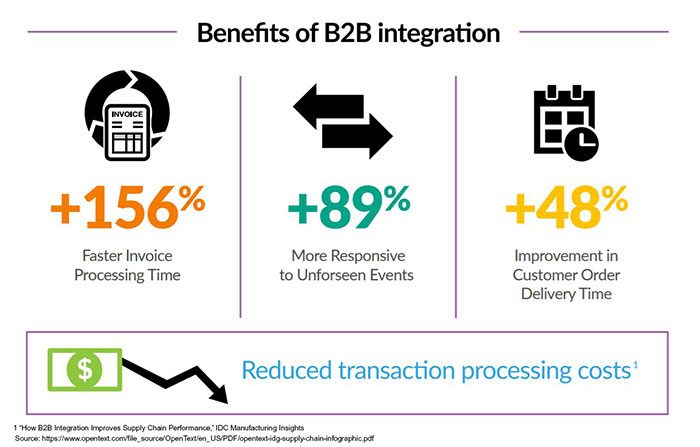

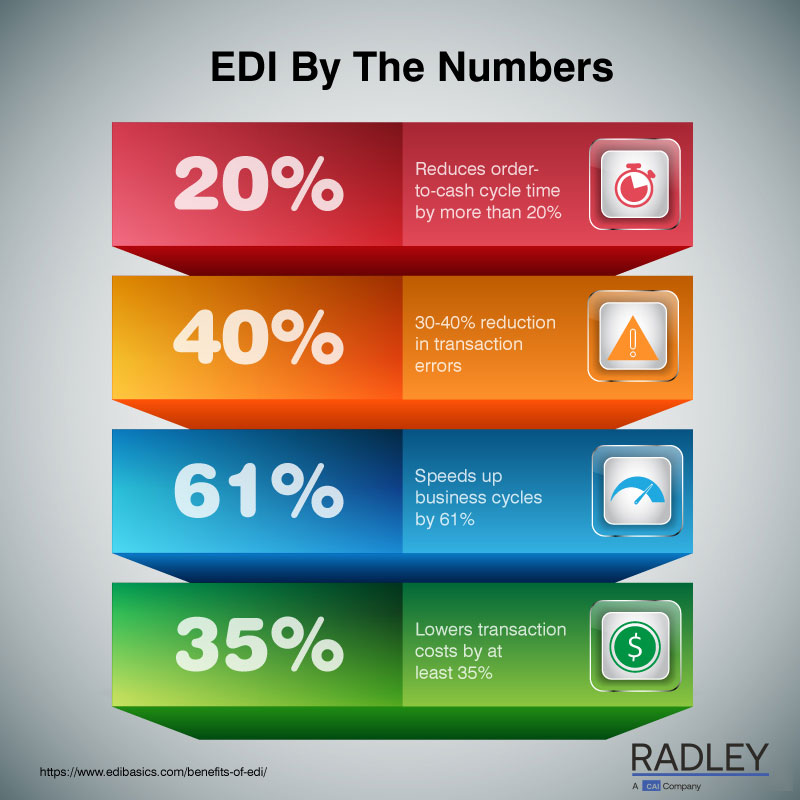

Benefits of Electronic Data Interchange (EDI)

There’s a reason EDI has gained widespread use across multiple industries over the last 40 years. Businesses can see significant savings in labor and materials cost, as well as increased customer satisfaction.

Faster, More Accurate Order Processing

Typically, an ERP’s inventory system notifies the buyer to place an order. Then, the buyer manually enters information into the purchasing system to create the PO. The purchase order is either emailed or mailed to the supplier who enters it into their sales system.

When the order is shipped, an invoice is emailed or mailed with the shipment. Finally, the buyer manually enters the invoice into their accounts payables system.

EDI streamlines this process by automatically generating and sending a purchase order when the minimum inventory level is reached. Minutes later, the supplier’s sales order system receives the PO and directly transmits the invoice to the buyer’s payables system.

Error-Proof Data

It’s no secret that manual data entry is prone to errors. From illegible handwriting, to keying mistakes, not to mention the inefficiency of the process as a whole.

The average benchmark for data entry error rate is generally acknowledged to be 1%. 3 According to a 2016 study by IBM, poor data quality cost US businesses $3.1 trillion.4 One of the benefits of EDI is ensuring that transaction data is accurate, thus establishing significant cost savings.

Reduced Costs

From paper supplies and storage space, to the personnel hand-keying data, the costs of manual document processing can be substantial. Automating the process lets you direct these funds to more productive areas of your business.

Shortened Lead Times

Because EDI facilitates faster order processing, it shortens the time to product delivery. For many manufacturers looking to implement a just-in-time inventory model, it’s critical to ensure fast product delivery based on customer demand.

EDI Implementation

There are a few things you need to decide once you’re ready to begin an EDI project.

Types of EDI

Just as there are many different standards of EDI, there are many ways of enabling EDI between trading partners. Below is a brief overview of the available methods. When it comes to implementation, your trading partners may specify the type of connection they require.

Direct EDI, also called point-to-point EDI, allows an individual direct connection between two trading partners. As a result, large companies with many trading partners may need to handle hundreds (or more!) of separate connections.

Also, each trading partner might want to use an EDI protocol such as AS2, FTP or others. These protocols let companies transmit data securely over the internet. However, with a direct connection, an organization must communicate with each business partner individually, which can mean managing hundreds or thousands of separate connections. Due to this complexity, few companies use the direct connection model for their EDI solution.6

What is a VAN? Also called an EDI Network Services Provider, a Value-added Network (VAN) is a third-party private hosting service. It allows organizations to channel their EDI communications without establishing separate protocols, as long as all partners are using the same VAN. This is a more efficient option for businesses who want to simplify their systems to support multiple trading partners.

So how does a VAN work? Think of it as a secure mailbox. Generally, the organization sends documents through the mailbox. Likewise, the company gets an alert upon receipt of a document into the mailbox.

Other benefits of a VAN service include an audit trail where EDI messages are recorded, as well as data backup or recovery.

Rather than using protocols like AS2 or FTP, web EDI uses a standard internet browser. While not a true EDI solution, it allows business to create and receive electronic documents.

Instead of paper-based documents, users enter information into a web form. Then, the form is sent securely over the web. Web EDI may be a more affordable—and easy-to-use—option for smaller companies with lesser transaction volumes.

For many businesses, EDI is an essential part of their supply chain. From streamlined processes to enhanced trading partner relationships, EDI provides many benefits. However, it does require some expenses for hardware and software, as well as demands on internal IT staff.

Because of this, many companies do not want to dedicate the resources needed to manage EDI. For them, outsourcing these tasks to a third-party provider is the ideal option. This is especially true if they wish to integrate EDI to an ERP or backend system.

Also called B2B Outsourcing, Managed Services let companies outsource the day-to-day management of their EDI systems. A provider monitors transactions, manages trading partner setup, as well as maintenance and patches.

As a result, the company can free up IT resources and reduce operational costs. Also, companies using B2B Managed Services have access to the latest server technology. Plus, they can add trading partners quickly, expanding their market opportunities.

As those late-night infomercials say, “But wait, there’s more!”

After deciding on your method of EDI connection, you’ll need to consider deployment options.

EDI Deployment Options

Deployment options include on premise or on the cloud. In on premise deployment, the software is loaded on servers at a company’s location.

One advantage to on premise EDI is the ability for in-house management. However, this option does require a skilled IT team with the bandwidth to manage updates and monitoring.

In contrast, a Cloud EDI deployment is hosted and managed at on off-site third party location. A company has access to their EDI data through their office computers.

How do you decide which EDI deployment is right for you? There are several factors to consider.5 Let’s first examine transaction volume.

EDI Transaction Volume

With an established set of trading partners, many companies have a steady level of transactions. This makes it easier to handle EDI as an in-house function. Therefore, on premise EDI could be the best solution.

However, if your company experiences growth, volume may change unpredictably. Thus, your internal IT staff may have a harder time managing the time and labor requirements necessary to add trading partners and manage the subsequent transaction volume. In which case, a cloud-based solution may be the best option.

Costs: Cloud vs. On Premise EDI

In addition to transaction volume, costs are always a consideration. As cloud-based EDI is a subscription model, you pay for what you use. So as your volume increases, so does your cost.

In contrast, on premise EDI requires an upfront expenditure for hardware. So, it’s important to keep in mind your current and future needs and how that might impact your budget.

Finally, security considerations can—and should—influence your decision. With data breeches, ransomware and malware in the news on a regular basis, you’d be right to wonder if your company’s data would be safe in the Cloud.

For many organizations requiring in-house control of their data, on premise deployment is a must-have. But, in the end, Cloud based EDI is, in fact, very secure. Still, it’s best to ensure you’re working with a service provider that has secure encryption in place.

How Much Does EDI Cost?

Speaking of fees, how much does EDI cost? The short answer is, it depends. Much of the costs depend on the volume of transactions.

The more transactions you have, the more data you’ll need to send. This is true whether you use a direct connection, a VAN or another type of EDI. Most transaction costs fall into either pay-as-you-go, monthly or subscription based models.

How to Choose the Right EDI Software

By now, it should be clear that choosing and implementing an EDI solution is not a simple task. But digital transformation is a hot trend right now and EDI is often an obvious choice for automating manual processes. While exchanging data electronically can bring efficiency, it’s important to carefully evaluate potential EDI companies.

Whether you choose to manage EDI using your internal staff or outsource it through Managed Services, here are some guidelines to consider:

Experience

Yes, there are a TON of EDI companies out there and, forty years on, EDI is not a new technology. As such, you may think that implementation is cookie-cutter by this point. So almost any tech company can handle it, right?

Well, even though software and services have been replacing paper-based documents for so long, each implementation is still unique. Therefore, it’s important to choose an EDI company that’s been around the block. You want a company that knows the right questions to ask to ensure your project goes smoothly.

Support

Flexibility

From standards and protocols, to deployment options and outsourced management, EDI options abound. The key is finding the combination.

You’ll need to comply with trading partner requirements, plus be able to support EDI in the long-term. The right EDI company can offer the right solution for you.

One of the most important factors is trading partner mapping. What trading partners has the company worked with before? Are they prepared to add more partners for you should the need arise?

Also, how do they handle fees for mapping your trading partners? You want to make sure that they can handle your current lineup of partners, and the system can grow with your business in the future.

Ability to Integrate

Sometimes companies use EDI as a stand-alone system, moving data from one trading partner’s ERP to another’s. More and more, there is a need to involve additional systems such as WMS, MES or CRM. The EDI company you choose also should be well versed in systems and EDI integration to facilitate connectivity between business systems.

What Is the Future of EDI?

Yes, EDI has a long history. But, there’s a reason it’s been the standard for document transfer since its widespread adoption back in the 1980’s. It works.

Today, there are some new kids on the block. For instance, many have proposed API as a contender to de-throne EDI. Also, you might have heard the buzz about blockchain. Let’s take a closer look at each.

Will API Replace EDI?

What is API?

API stands for Application Program Interfaces. Developed in the early 2000’s, API finds use in Cloud SaaS (Software as a Service) applications and, like EDI, quickly moves data from one system to another.

Is API Better than EDI?

Yes, API has its advantages. It may cost less because it does not require on-going maintenance or translation services. Instead, API uses a real-time interface to send and receive transaction information. When it comes to supply chain management, real-time data accessibility can help companies quickly respond to issues and make faster business decisions.

But, even as research suggests more and more companies are moving to API, there are definite drawbacks to its use. In terms of functionality, API is not the same as EDI.

An API is usually coded to the specs of a particular trading partner transaction. So it does not have the inherent flexibility of EDI. So, when you’re looking to add new transactions or trading partners, don’t expect a quick process.

Also, API does not have defined standards like X12 or EDIFACT. Because of this, there is no agreed upon standard of how transferred information will be formatted. As a result, additional coding will need to be performed in order to meet compliance requirements between trading partners.7

Can Blockchain Replace EDI?

What is Blockchain?

Blockchain is what’s called a “distributed ledger.” This is an online ledger where transactions are recorded and distributed, giving anyone in the network access to it.

Transaction information is stored in blocks of computer code. A block is a record of new transactions. The information in a block is updated and verified in real-time.8 This end-to-end visibility and real-time updating is an advantage blockchain has over EDI.

Also, another argument for blockchain is the potential cost savings. EDI is generally priced on a per-transaction basis. In contrast, a blockchain network is charged per project.9 So while there is cost incurred in the initial network setup, individual transaction fees may be avoided.

EDI Is Here to Stay

However, there’s a reason EDI has enjoyed longevity. EDI standards let trading partners exchange information using a common format. This value remains intact, regardless of the new technologies that have threatened to replace EDI.

While blockchain may push improvements to EDI’s visibility and cost drawbacks, it’s unlikely that EDI is going anywhere. Instead, there is a case to be made for EDI transactions to be made via blockchain versus the current VAN networks or internet connections. 8

Conclusion: EDI for Business Success

While some consider EDI an outdated technology, its value today remains solid as a reliable, secure method to streamline and automate routine business transactions.

An EDI system can provide many benefits. These may include faster order processing, error-proof data, reduced costs and shortened lead times. Many options are available for EDI connectivity, so choosing an experienced EDI company is critical to your project’s successful implementation.

Learn More

Continue reading about What is EDI and the benefits of Electronic Data Interchange (EDI) on Radley’s Blog.